Key Economic Concepts of Karl Marx

This document presents an overview of Karl Marx's key economic concepts. Unlike The Economics of Needs and Limits, which deals with normative issues (the economy as it should be), the ideas presented here deal with positive issues (the economy as it is).

Marx created a penetrating framework for analyzing capitalist economies, but this work has been ignored and badly distorted by mainstream thinkers. Even Marxists tend to emphasize the political side of Marx and downplay his economic contributions. It is important that progressive thinkers reverse this tendency and rediscover Marx's extremely useful economic concepts, which offer an alternative mode of analysis to the tools of mainstream economics.

1. Use-value and Exchange-value

As in standard economics, use-value for Marx is the usefulness or utility of a commodity, as judged by the consumer. A house, a hamburger, a cigarette, and a concert all have use-values to the degree that consumers desire them. Use-value is entirely subjective

The point of departure between standard economics and Marx is exchange-value. This refers to the capacity of one object or service to be exchanged for another. If one unit of commodity A exchanges for 10 units of commodity B, then A has 10 times the exchange-value of B.

In standard economics, exchange-value has entirely disappeared as an operational concept. All exchanges are considered to be driven by price, and price is derived from the willingness of consumers to pay and the willingness of capitalists to produce - in other words, exclusively by supply and demand in the market.

Marx's view does not deny the roles of the market, price, supply, or demand, but insists that exchange-value is a separate concept, permitting the analyst to delve beneath superficial market phenomena to address capitalism's underlying systemic reality.

In this view, exchange-value establishes the equilibrium price of a commodity. While market forces cause price to deviate from this equilibrium, it will always tend to return to its exchange-value. In other words, for Marx the equilibrium price of a commodity is established by exchange-value, which exists BEFORE the commodity enters the market. In the standard view, the equilibrium price is established BY the market itself.

This distinction may appear minor, but it has enormous consequences. If equilibrium price is set in the market, then most important economic phenomena can be understood by focusing on exchange - the buying and selling that constitute commercial activity. If it is established prior to the market, then we are compelled to probe the production process as well. And it is here that worker meets capitalist - that social and class relations enter the economic picture.

For Marx, the exchange-value of a commodity is established by the socially necessary labor time required for its production. "Socially necessary" means that the commodity was produced using prevailing technology and organizational methods, resulting in at least the socially average productivity. Equilibrium price is the monetary expression of this exchange-value.

This is called the labor theory of value. Despite its simplicity, it is often misinterpreted and distorted. Let me clarify its meaning by addressing some of these errors.

First, exchange-value in economics has little to do with "value" in everyday usage. We may value something highly in the general sense - an heirloom, a relationship, a natural setting - but this has no bearing on the regulation of commodity prices under capitalism.

Second, the labor theory of value is not a normative statement - it does not pretend to dictate what should be true. Instead, it is a positive statement - it is a claim about how capitalism actually works. Marx did not say that price should be regulated by socially necessary labor time, but that capitalism has evolved so that this is in fact the case.

Third, the theory does not ignore scarcity. For something to have exchange-value, it must be scarce in the sense that economic production is required to obtain or create it. Marx agreed that scarcity is a condition for exchange-value; what he denied is that scarcity is its measure. There is in fact no way to establish "how much" scarcity is associated with an object. How scarce is a pen? A personal computer? A barrel of oil? The only way to quantify scarcity is to measure the resources required to obtain the scarce object. For Marx, these resources boil down to socially necessary labor time.

Regarding the role of nature, Marx's position was that natural resources are the basis for use-value, but do not enter into exchange-value. Under original conditions, the price of lumber reflects the labor time required to fell the tree, bring it to a mill, saw it, and bring the resulting lumber to market. Once land is owned privately or by the state, a charge will be made for the tree as well. This is payment for monopoly ownership, however, not for the natural resource.

Fourth, the theory does not ignore the contributions of capitalists. Although this may be a key reason why standard economics has developed such a loathing for exchange-value, it is entirely without basis.Marx stated repeatedly that capitalists are essential elements in modern production, and that their role is instrumental in creating exchange-value. What he denied, however, is that this contribution enters into the exchange-value of a commodity. Capitalists grow rich, or go broke, through their legal claim to profits. But this is a residual quantity - revenues minus costs. It is not a constituent of exchange-value.

Last, the theory is not intended to apply universally. Things that are inherently rare because they are produced by unusual talents or under extraordinary conditions are not governed by the labor theory of value. The theory applies to normal commodities only - those produced by standard human labor and under generally accessible conditions. The prices of intrinsically rare things are governed entirely by market forces.

To summarize: the labor theory of value states that if a normal object or service is scarce and has use-value, socially necessary labor time is the measure of its exchange-value. This exchange-value underlies and regulates, but does not uniquely determine, its market price, which is also affected by short-term variations in supply and demand.

2. Necessary and Surplus Value

In a capitalist system, standard labor-power is a commodity, just like milk and CDs. As a commodity, labor-power has an exchange-value - the socially necessary labor time required to produce it. The exchange-value of labor-power is the labor time necessary to produce the food, clothes, housing, education, entertainment, etc. of the typical worker. The price of labor-power (salaries and wages) is the monetary expression of this exchange-value.

Note that the reference here is to labor-power, not labor. Labor-power is the worker's capacity to provide labor, which is distinct from the labor itself.

The capitalist pays for labor-power, but obtains labor. This creates the possibility that the commodities produced by the worker over a period of time contain more exchange-value than is contained in the labor-power paid for during this period. This possibility is capitalism's key dynamic feature and driving force.

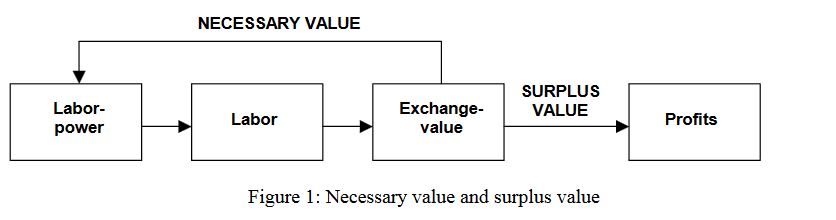

The exchange-value that capitalists pay for labor-power is called Necessary Value. The difference between the commodities' exchange-value and necessary value is called Surplus Value.

When commodities are sold, the necessary value they contain is returned to workers as salaries and wages. The surplus value that remains is distributed to capitalists - primarily as profits, but also as interest and rent. The following diagram depicts this flow and distribution:

Surplus value is usually linked to the "exploitation" inherent in capitalism. This interpretation is due partly to Marx's own statements, but also to the predominantly political interpretation of his work. I use surplus value in a politically neutral sense, referring only to the appropriation of part of the commodity's exchange-value by the capitalist.

Surplus value lies at the heart of capitalism. Capitalists establish new enterprises, develop and apply new technologies, swallow up rivals, expel wastes to the environment, and coerce their workers in order to maximize their surplus value. For the capitalist this struggle is expressed in business terms, butsurplus value lies, mute and unrecognized, just below the surface of daily commerce.

3. Surplus Value

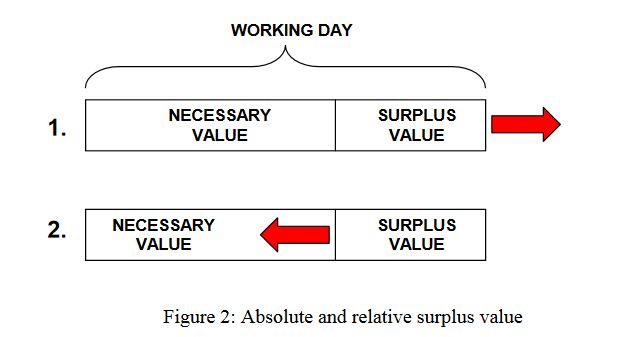

There are two distinct ways for a capitalist to increase surplus value, as shown in the following diagrams:

Method #1 entails an increase in the working day. If the capitalist can get away with this without increasing pay, surplus value will clearly increase. Marx called this Absolute Surplus Value.

Method #2 entails a decrease in necessary value, with the working day remaining constant. This means the worker is paid less, and more surplus value is left for the capitalist. Marx called this Relative Surplus Value.

4. Capital

If surplus value is capitalism's heart, capital is its living soul. Nevertheless, definitions of this central term vary widely.

Standard economists see capital as the buildings, machines, and materials used in production, or alternatively as the money required to purchase these assets. Using this definition, capital has been employed through much of history.

Many environmentalists see capital as a stock from which a revenue or other benefit can arise. Here the generalization goes even further: capital is not only the material or monetary basis of production, it also refers to natural resources ("natural capital"), social values ("social capital"), and human skills ("human capital").

Marx's definition differs significantly from either usage. For him, capital is specific to capitalism (hence the system's name), and refers to exchange-value that expands in production through the addition of surplus value. Capital can take the form of tangible productive assets, just as it can take the form of commodities and money, but its essence is the recurring cycles of expanding exchange-value in production and market exchange.

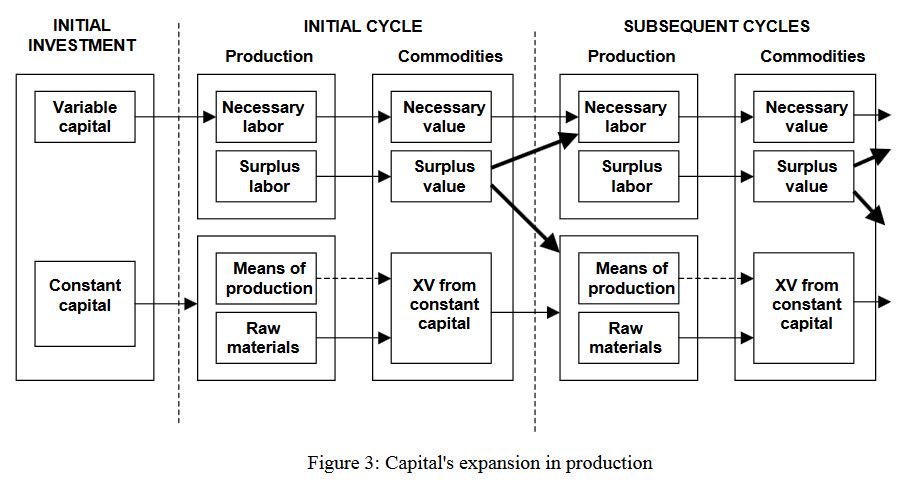

The following diagram summarizes this process:

Several new terms are introduced here.

VARIABLE CAPITAL is money used to purchase labor-power. This portion of capital expands in production through the addition of surplus value.

CONSTANT CAPITAL is money used to purchase means of production (buildings, machinery, etc.) and raw materials. This portion of capital does not expand in production.

NECESSARY LABOR is that portion of labor time that will be transformed into necessary value.

SURPLUS LABOR is that portion of labor time that will be transformed into surplus value.

Production is initiated when one or more capitalists, perhaps in the form of a corporation, accumulate enough money to purchase the labor-power, means of production, and raw materials required for the chosen commodity. In other words, they are able to advance sufficient variable and constant capital for the selected process.

In the initial production cycle, the advanced variable capital purchases labor-power (necessary labor), and the advanced constant capital purchases means of production and raw materials.

During the production process, necessary labor creates necessary value, and surplus labor creates surplus value. Both forms of exchange-value are transferred to the commodities being produced.

Exchange-value is also transferred from the means of production and the raw materials. These elements of the process are themselves commodities from a prior production process, and therefore have exchange-values. It is these previously created exchange-values that are transferred to the new commodities.

The entire exchange-value in the raw materials is transferred. For the means of production, only the fraction used up in the process is transferred - hence the dashed lines in the drawing. For example, if the exchange-value of a machine is 1,000 units of a currency, and if it can produce 10,000 units of the commodity before being worn out, then it transfers 0.1 units of the currency to each unit of the commodity.

After the initial cycle, our capitalists possess commodities that contain necessary value, surplus value, and the exchange-value transferred from the means of production and the raw materials. The trick now is to sell these commodities in the market at the anticipated prices so that all these values can be turned back into money, including the anticipated profit.

If this is successfully accomplished, then money will be available to pay the necessary labor, means of production, and raw materials for the next production cycle. In addition, surplus-value will be available for capitalist consumption and to re-invest in production to grow the enterprise. This cycle continues until business conditions or other circumstances bring it to a halt.

In this process, capital starts as money, is transformed into productive assets and then commodities, and is finally transformed back into money - augmented by surplus value - through commodity sales in the market. This is capital - expanding exchange-value through the cycle of production and exchange.

5. Price

Earlier I stated that exchange-value establishes the equilibrium price of a commodity, and that market forces cause price to fluctuate around this equilibrium. Here I would like to explain the relationship between exchange-value and price in more detail. This will permit me to address supply and demand from Marx's perspective.

Commodities contain three components of exchange-value: necessary labor, the part transferred from constant capital, and surplus value. The capitalist has to pay for necessary labor and constant capital, and gets the surplus value for "free".

The total amount of money a capitalist has to pay to produce a commodity - necessary labor plus constant capital - is known as COST PRICE. If the commodity's average price is less than this at time of sale, the capitalist will lose money and will sooner or later go out of business. If the average price is higher, the capitalist gains profits, but will have to satisfy investors that these profits are high enough.

When selling a commodity, the capitalist does not necessarily capture all the surplus value generated by his or her commodity. Surplus value greater than the social average will draw competition from other capitalists until the amount is reduced to the social average. As a result, in a competitive capitalist economy at equilibrium, all capitalists earn the same percentage of surplus value relative to the capital invested.

This means that the equilibrium price for a commodity is the cost price plus the socially average surplus value. This is known as the PRICE OF PRODUCTION.

When a capitalist decides whether or not to produce a commodity, the key question is: will the sale of this commodity fetch its price of production? That is, will I earn the socially average surplus value for the money (capital) invested in this process? The same question is asked by investors when they decide where to place their funds.

If the answer is no, then no matter how beneficial the commodity would have been for humankind, it will not be produced. If the answer is yes, then no matter how destructive the commodity will be for humankind, it will be produced.

Finally, the market price for a commodity fluctuates around the price of production - the commodity's equilibrium price. If demand increases, price will be temporarily higher. If demand decreases, price will be temporarily lower. This is the issue of supply and demand that so consumes standard economists. We'll consider this next.

6. Supply and Demand

In standard economics, the supply-demand diagram is probably the most important tool of analysis. Standard analysis focuses on the surface features of a capitalist system, and variations in supply and demand are among the most significant of these features.

I agree that the supply-demand diagram is important - surface phenomena play a large role in our lives, and the dynamic shifts must be fully acknowledged. The major conceptual difference is that supply and demand are seen as variations to an underlying reality based on exchange-value, whereas for standard economics this reality is a myth. As one of my economics professors told a class: "Exchange IS economics".

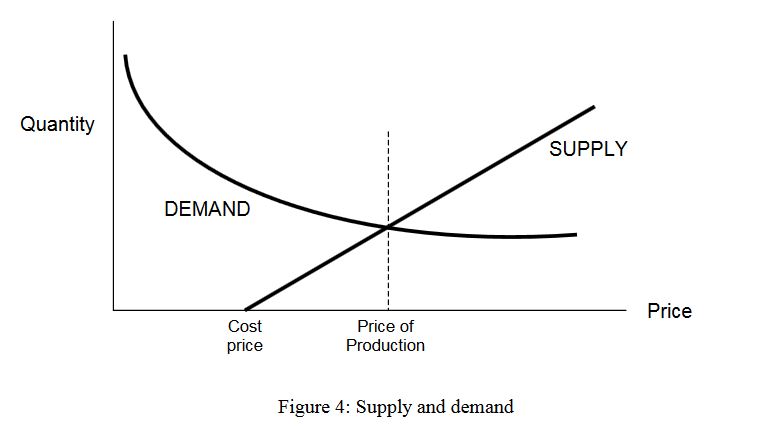

Below is my version of the standard supply-demand diagram:

This diagram looks much like those in standard economics texts, but there are significant differences.

First, the axes are reversed. For unknown reasons, standard economics has stuck with the convention adopted in the late 1800s by English economist Alfred Marshall. Marshall put price, generally considered to be the independent variable, on the Y-axis, whereas the norm in mathematics is to put the independent variable on the X-axis, as above.

The demand curve is the same as in standard economics: price and quantity demanded are inversely related, based on the facts of consumer behavior.

The supply curve is based on the motivation and behavior of capital, using the terms previously introduced. Quantity supplied is zero until cost price is reached. At this price some capitalists will produce to cover their costs, in the hope of future profits. At the price of production, quantity supplied exactly matches quantity demanded. This is the equilibrium situation.

The substantive difference between this diagram and standard versions is that equilibrium is at the intersection of the demand curve and the price of production. This reflects the centrality of the price of production and its exchange-value components. In standard economics, equilibrium is at the intersection of the demand and supply curves, an approach that addresses short-term market phenomena, but ignores underlying exchange-value.

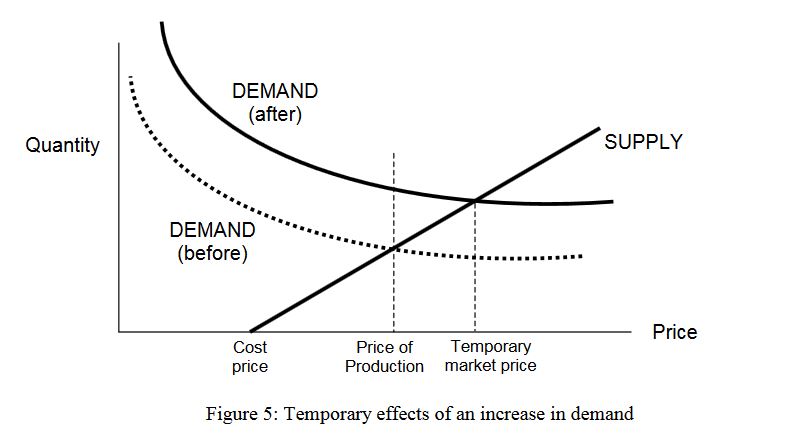

As an example of how this supply-demand treatment handles dynamic changes, consider the following two diagrams, which depicts an increase in demand. (Note that I retain a useful distinction made in standard economics: A change in demand is a shift of the demand curve, reflecting a change in consumer behavior. A change in quantity demanded is a movement along the demand curve, reflecting a change in price but within the same behavior pattern.)

The "before" and "after" curves show that demand has increased. At any price, quantity demanded has become greater. The dashed vertical line at right shows that this dynamic shift has caused the market price to increase above the equilibrium price - the price of production.

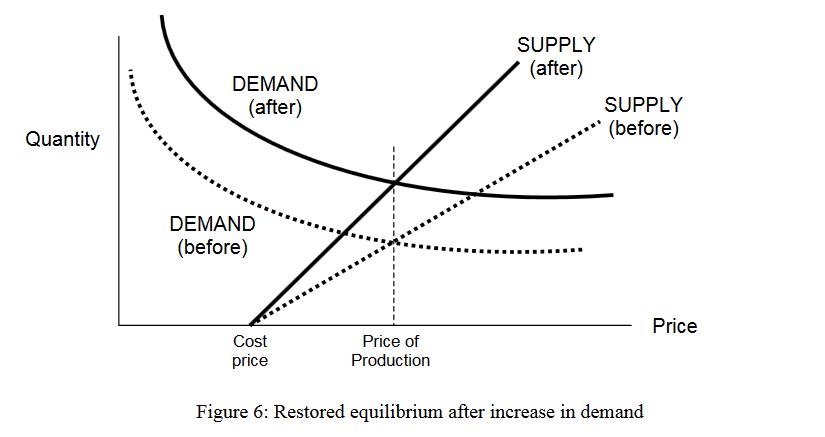

When capitalists have had a chance to react to this change, production of the commodity will increase. The cost price has not changed, so the supply curve cannot shift in its entirety. Instead, it rotates to the left, as shown below:

In the new equilibrium situation, market price has returned to the price of production, reflecting the underlying exchange-value which was unaltered by the change in demand conditions

7. Capitalism and Growth

One of the ways that capitalists compete with each other is by cheapening their product, thus permitting the capitalist to sell the commodity at a lower price than competitors. This is done by reducing the amount of labor-time incorporated in the product.

This can be done by replacing labor with machinery, if a specific condition is met: the machinery must incorporate less labor-time than the labor power it replaces. For example, if the machinery incorporates 100 hours of labor, and the replaced labor power incorporates 120 hours, then the machinery will cheapen the product and give the capitalist a competitive advantage.

This process is one of the key driving forces of a capitalist economy, and it has significant consequences. To stay alive, all competing capitalists must sooner or later introduce similar machinery, thus releasing workers to other sectors of the economy and to the unemployment line. Social productivity rises, and both the profit rate and the ratio of variable capital (labor power) to total capital declines.

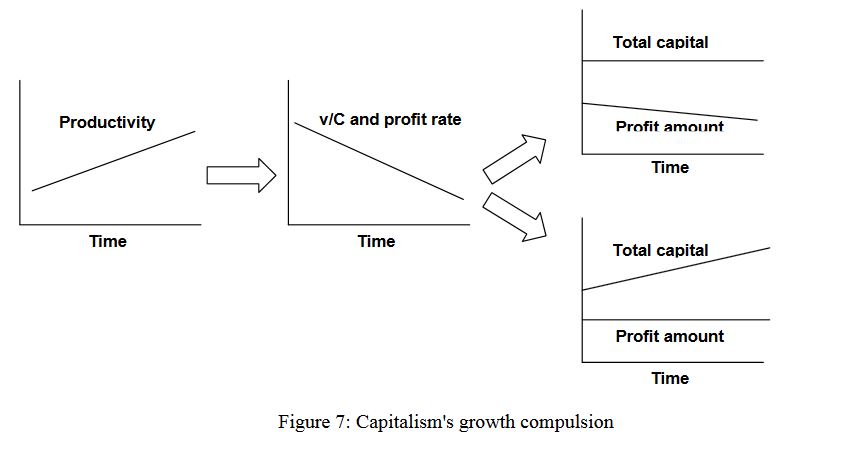

The diagram below shows this in the two graphs at left (v = variable capital; C = total capital):

For capitalists, the problem with a declining ratio of variable to total capital is that the profit rate will decline, as shown in to top graph at right. This is true because variable capital is the source of surplus value. Unless the rate of surplus value increases, this declining ratio will mean that for every unit of total capital invested, less profit will result. This is acceptable only to a limited degree, beyond which the social and economic status of capitalists will be threatened.

The solution is economic growth - an increase in total capital such that the amount of variable capital remains the same or increases, even though the ratio of variable to total capital declines. If this occurs, the amount of profit remains the same or increases, thus satisfying capitalist requirements.